This falling wedge is a continuation pattern because the slope (downward) of the wedge is against the direction of the trend (uptrend). The slope of the wedge is against the previous trend. What makes this wedge a continuation pattern?

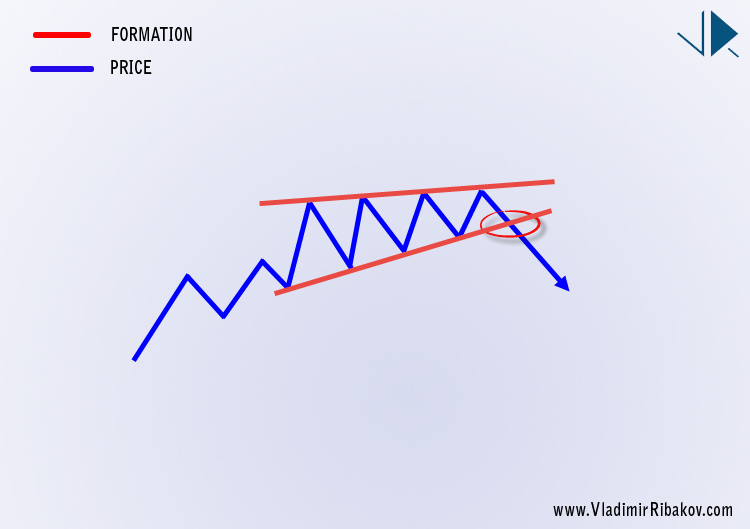

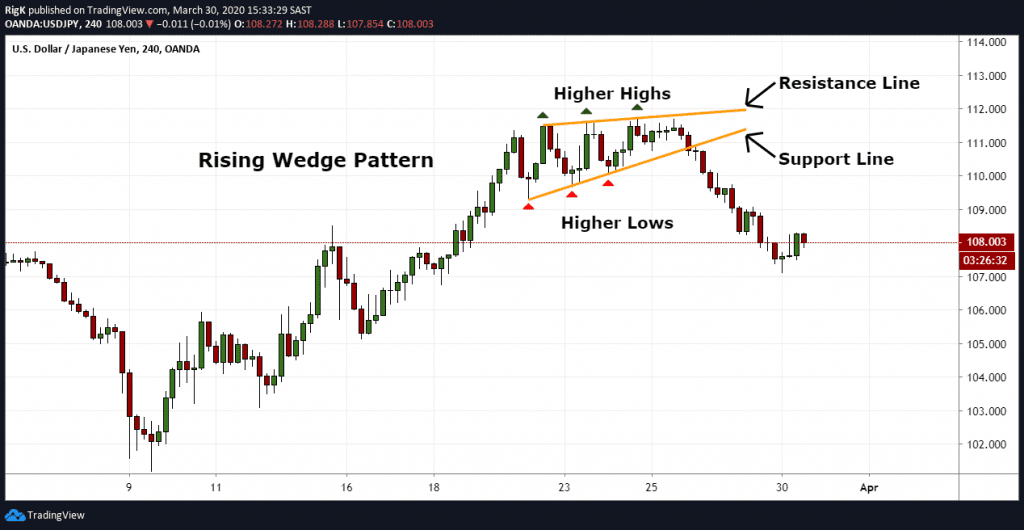

This pattern is completed when the price breaks through the resistance trendline. Two or more touched points are required to form the converging trendlines. The highs and the lows of the pattern form a falling wedge. It starts out wide, but narrows as prices keep going down. Continuation Falling WedgeĬontinuation falling wedges are a bullish continuation pattern. When the pattern got completed (support trendline got broken), led to further downside movements. This rising wedge is a continuation pattern because the slope (upward) of the wedge is against the trend (downtrend). This pattern is completed when the price breaks through the support trendline. It starts out wide, but narrows as prices keep going up. Continuation Rising WedgeĪs all wedges, this one begins wide and contracts as the market reaches new highs:Ĭontinuation rising wedges are a bearish continuation pattern. Depending on where the pattern was formed and its slope it could signal a continuation of the trend or a trend reversal. The reason is simple, these patterns can be either reversal or continuation patterns. With practice and patience, you can become proficient in trading wedge chart patterns in forex.You may wonder why is it that we have the falling and rising wedge in a separate section. Additionally, it is important to have a solid trading strategy and risk management plan in place. Remember to identify the wedge pattern, wait for confirmation, enter the trade in the direction of the breakout or breakdown, set stop loss and take profit levels, and monitor the trade closely. Trading wedge chart patterns in forex can be profitable if done correctly. If the price moves against you, consider closing the trade to limit your losses. If the price moves in your favor, consider trailing your stop loss to lock in profits. Monitor the trade closely and adjust your stop loss and take profit levels if necessary. Take profit levels can be set at the next support or resistance level. Place your stop loss above the upper trendline for a short trade and below the lower trendline for a long trade. Set your stop loss and take profit levels based on your risk tolerance and trading strategy. For a falling wedge pattern, enter a long trade when the price breaks above the upper trendline. For a rising wedge pattern, enter a short trade when the price breaks below the lower trendline. A breakout occurs when the price breaks above the upper trendline, while a breakdown occurs when the price breaks below the lower trendline.Īfter confirmation, enter a trade in the direction of the breakout or breakdown. Confirmation can come in the form of a breakout or a breakdown of the trendlines. Once you have identified the wedge pattern, wait for confirmation before entering a trade. Remember that a rising wedge pattern indicates a potential bearish trend reversal, while a falling wedge pattern indicates a potential bullish trend reversal. Look for a narrowing price range and connect the highs and lows with trendlines. The first step is to identify the wedge pattern on the chart. Here are some steps to follow when trading wedge chart patterns: Trading wedge chart patterns can be profitable if done correctly.

This pattern indicates a potential trend reversal from bearish to bullish.

A falling wedge pattern is formed when the price range narrows, and the lower trendline is sloping upwards. This pattern indicates a potential trend reversal from bullish to bearish. The upper trendline connects the highs, while the lower trendline connects the lows.Ī rising wedge pattern is formed when the price range narrows, and the upper trendline is sloping downwards. Wedge chart patterns are formed when the price range narrows, creating a triangle shape on the chart.

#RISING WEDGE FOREX HOW TO#

In this article, we will discuss how to trade wedge chart patterns in forex.īefore we discuss how to trade wedge chart patterns, it is important to know how to identify them.

There are two types of wedge patterns – rising wedge and falling wedge. A wedge is formed when the price range narrows, creating a triangle shape on the chart. Wedge chart patterns are popular among forex traders as they can signal a possible trend reversal or continuation.

0 kommentar(er)

0 kommentar(er)